Traders and lawyers know when a company is about to go under. So should you.

Illustration: Cath Kastner

“Bankruptcy” is a dirty word in boardrooms, on trading floors and in employee break rooms. There’s good reason: Insolvency tarnishes reputations, wipes out stockholders and kills jobs. Thankfully, corporate failures are rarely surprising to those who know what to look for. Close observers fully expected the recent bankruptcies of coworking giant WeWork Inc. and pharmacy chain Rite Aid Corp. Almost 200 companies with debts of at least $50 million declared bankruptcy this year—the most since the global financial crisis, except for 2020, during the Covid-19 pandemic. The wave shows no signs of ebbing as high interest rates weigh down corporate balance sheets. So how do you know if a company is about to go under? Read on.

Stock, bond and loan prices are the quickest way to spot a troubled company. When brokers offer floating-rate loans for less than 80¢ on the dollar, there’s little doubt the borrower is struggling. That price means lenders don’t expect the debt to be repaid in full. Almost a year before Rite Aid went bankrupt, one of its bonds traded for less than half its face value.

Rite Aid’s Woes Were Obvious to Bond-Market Watchers

Price of the company’s bond maturing on Feb. 15, 2027, weekly

Featured in the December 2023/January 2024 issue of Bloomberg Markets Illustration: Micha Huigen for Bloomberg Markets

Failing companies often pay so-called retention bonuses to top executives so they won’t quit during a tough restructuring, a fire sale or another crisis. The payments can total millions of dollars.

Healthy companies talk about shareholders. Sick ones talk about creditors, such as banks, debt investors and landlords. They’ll put a nice sheen on negotiations that, in reality, amount to cries for mercy. Two months before it went bankrupt, WeWork’s new chief executive officer said the company was “kicking off a process of global engagement with our landlords” to ask for rent concessions.

*Jenny Craig company statement to Bloomberg three months before the weight-loss brand shut down. A spokesman says the brand had a successful relaunch with new owners in September.>

As businesses sink deeper into distress, their suppliers will demand tighter trade terms, including upfront payment. If an ailing company is big enough—and important enough to its suppliers—it may try the reverse, seeking more flexibility in a bid for breathing room.

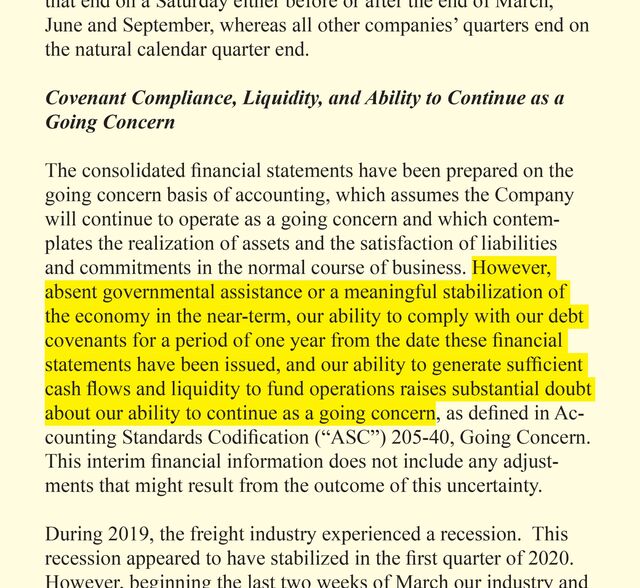

In addition to checking the books, public accounting firms have to assess their clients’ viability and, if doubts arise, say so in regulatory filings. Going-concern warnings are the most surefire cause for alarm there is.

Act II:

Bankruptcy Begins>

Companies that go bankrupt will announce the move using coded language that ranges from optimistic to evasive. Translation is essential. The following examples are real.

“WeWork Takes Strategic Action to Significantly Strengthen Balance Sheet and Further Streamline Real Estate Footprint”>

→ WeWork filed for bankruptcy and plans to ditch expensive leases, close locations>

“Implement an orderly wind-down”>

→ Full-blown liquidation>

“Seeks to Execute Comprehensive Recapitalization”>

→ Company sees a path to survival, but it isn’t guaranteed>

“Takes Steps to Accelerate Transformation and Position Company for Long-Term Success”>

→ Company has gone bankrupt and has tentative restructuring deal>

“Reaches Agreement to Become A Private Company”>

→ Creditor is taking over the business>

“Store footprint optimization plan”>

→ Closing locations en masse>

The more well-planned a bankruptcy, the better the chance a company will survive.

Companies that go bust with no set turnaround plan are said to be in free fall. This leads to expensive and uncertain bankruptcies, such as FTX’s.

In a prepackaged restructuring, a company presents a debt-repayment plan to creditors before even filing for bankruptcy. This move is desirable. In 2021 department-store chain Belk Inc. pulled one off in less than 24 hours.

Some restructurings are called prearranged or prenegotiated, terms of art that mean some, but not all, details of a bankruptcy-emergence plan have already been worked out.

What restructurings typically involve:

An attempt to sell the company or…>

Creditors agreeing to forgive debt in exchange for equity in the business or …>

A combination of the two>

If at any point the company says it’s beginning to wind down operations or convert the case to Chapter 7 of the bankruptcy code, the game is over. Everything is shutting down and being sold as fast as possible. Discount retailer Christmas Tree Shops Inc. liquidated itself in 2023 after first saying it would close a few stores during a Chapter 11 bankruptcy reorganization.

Companies typically exit bankruptcy with new owners and, often, new leadership. It’s up to the new parents to determine what the future holds. Usually the business is smaller.

Sometimes the company doesn’t emerge at all, but its spirit does. Many retailers shut down their operations and fire their employees but sell their brand and intellectual property to the highest bidder, because they’re still worth something. Overstock.com, for example, bought Bed Bath & Beyond’s IP but none of its stores.

Stockholders almost never get a payout at the end of a bankruptcy. That’s because lenders, bondholders and landlords have to be repaid first, and there usually isn’t enough money left to pay them in full.

Exiting bankruptcy doesn’t mean a company is healthy. Plenty of companies go bankrupt again and again, sometimes within a year of their exit. Repeat cases are jokingly called Chapter 22s or Chapter 33s. Generic drug maker Mallinckrodt Plc filed for bankruptcy in 2023, less than three years after another Chapter 11 filing.

Hill covers distressed companies from New York.