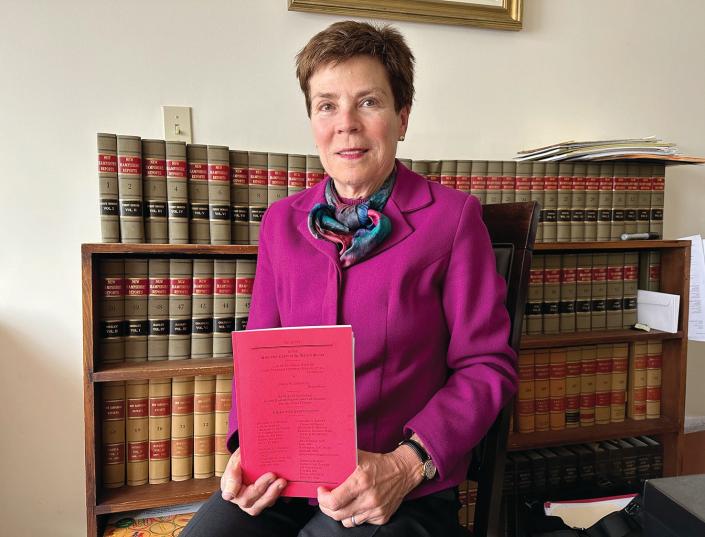

For Exeter attorney Terrie Harman, appearing before the U.S. Supreme Court for the first time on April 24 was exhilarating.

It’s a great privilege and a rare opportunity to appear before SCOTUS, and that is not lost on Harman.

“It’s every lawyer’s dream to go to the U.S. Supreme Court,” she says. “It was incredibly exciting. I can hardly believe that I went.”

Harman graduated from Franklin Pierce Law School in 1978 and began working at Pine Tree Legal Assistance in Bangor, Maine. There, she learned about bankruptcy law while representing indigents and developed a passion for the Bankruptcy Code. In the 1980s, she started her own firm, Harman Law Offices, where she was heavily involved in bankruptcy litigation and later became a Chapter 7 Bankruptcy Trustee.

Nowadays, her practice is mostly focused on probate litigation, estate planning, and general civil litigation, but it was one of her old bankruptcy cases that caught the eye of Boston lawyer, Richard Gottlieb, leading to a phone call that would place