-

- Leading prison health provider Corizon Health split last year and filed one company, called Tehum, into bankruptcy

- Sources tell Insider the parties reached a tentative settlement of $30 million, a small fraction of the company’s debt

- That deal could leave hospitals and hundreds of prisoners who claim they were harmed by Corizon with tiny settlements

- Sen. Elizabeth Warren is now looking into Corizon’s use of a controversial legal maneuver called the Texas Two-Step

Corizon Health, once the nation’s largest prison healthcare provider, reached a tentative bankruptcy deal last week that could leave hundreds of prisoners with pennies on the dollar for their medical malpractice claims.

If the settlement is approved, it would mean that Corizon’s owners succeeded in their use of a controversial financial maneuver called the Texas Two-Step. In a recent civil complaint, Isaac Lefkowitz, a company representative, said the Two-Step is used to “force plaintiffs into accepting lower payments.”

Sen. Elizabeth Warren has called Corizon’s use of the Two-Step “an alarming red flag.”

According to two people close to the negotiations, the settlement figure is around $30 million. The amount could still change as the agreement is made final.

Priority claims, such as attorney’s fees, would be paid out first. One of the sources said those fees may be roughly $9 million, which would leave around $20 million for all the other creditor claims.

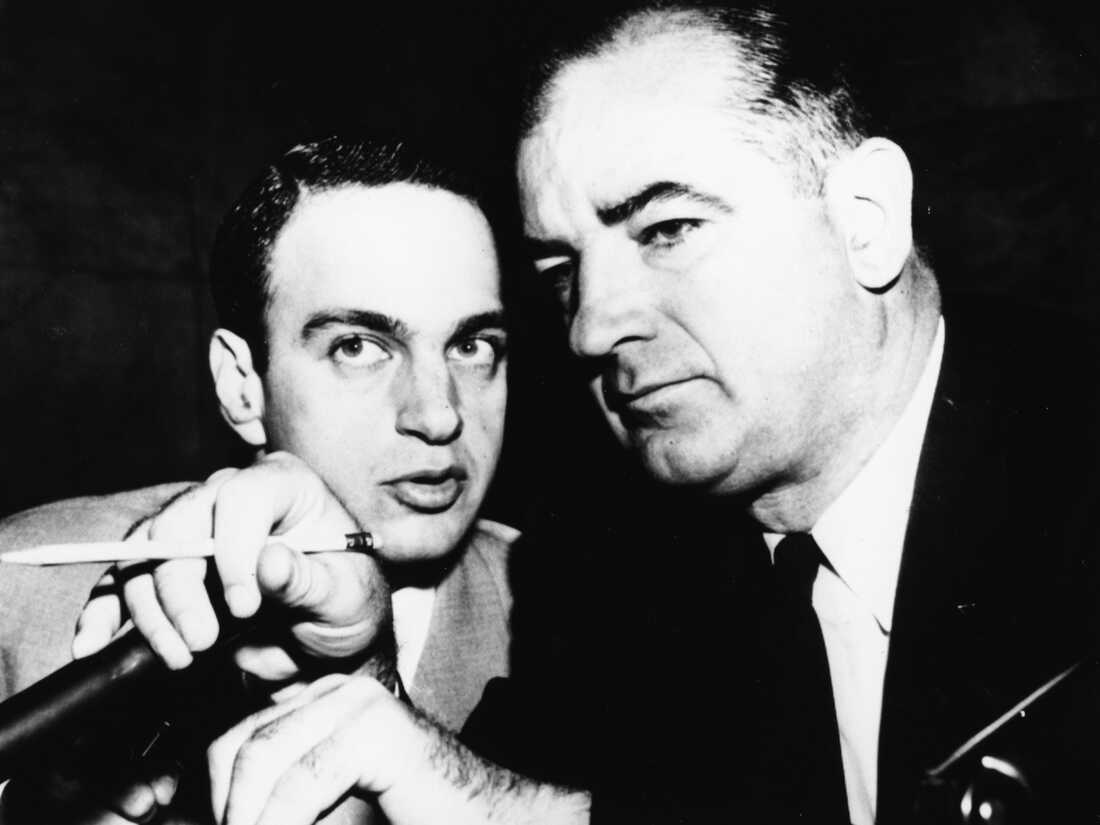

Sylvia Jarrus for Insider

Corizon Health rebranded as Tehum Care Services last year and filed for bankruptcy in February. As of July, Tehum faced at least $88 million in claims over unpaid invoices from medical providers and 44 employment-law suits, in addition to at least 475 lawsuits filed by current and former prisoners and their families alleging negligent care. These include suits filed by William Kelly, who claimed that his kidney cancer progressed to stage 4 while he was under Corizon’s care in Michigan prisons; Tracey Grissom, who filed suit in 2019 saying that Corizon’s failure to provide a properly fitted ostomy bag at the Alabama prison where she was held forced her to live in her own feces for four months; and the family of Hector Garcia, who died after being under Corizon’s care for only a few days in New Mexico. (Corizon has disputed all three claims in court; attorneys say it’s unclear whether the bankruptcy deal will release other defendants in the 475 cases.)

In total, Tehum has reported $176 million in unsecured debt it seeks to resolve with the settlement.

Tehum and a committee representing the creditors agreed to mediation in May in an order signed by US Bankruptcy Judge Christopher Lopez, who is overseeing the bankruptcy case for the Southern District of Texas.

Last Friday, after three days of mediation talks, Aaron Kaufman, an attorney representing Tehum, told the court that Tehum and its creditors’ committee had reached a preliminary settlement that would “resolve all disputes among the debtor and the mediation parties.”

Kaufman declined to provide any details about the settlement in court, saying they would be shared in the coming weeks when Tehum files a detailed liquidation plan. He also declined to comment on the record to Insider.

The Texas Two-Step

As Insider reported, the settlement is the end game in Corizon’s Texas Two-Step, a controversial legal maneuver the company employed to wall off most of its assets from these claims.

Last year, Corizon moved its incorporation from Delaware to Texas, where state law permits something called a divisional merger, allowing companies to split in two, keeping most assets with one company and consigning most debts to another.

Corizon gave one company, known as YesCare, all of Corizon’s active contracts with state and local governments, worth hundreds of millions of dollars. Two months later, YesCare won a new multiyear contract for more than $1 billion to provide healthcare to prisoners held by the Alabama Department of Corrections.

The other company, Corizon, later rebranded as Tehum, received most of the parent company’s liabilities — and then declared bankruptcy.

Sen. Elizabeth Warren is examining Corizon’s use of the Two-Step following Insider’s reporting, according to spokesperson Alex Sarabia. Insider uncovered evidence that Corizon’s new owners, who purchased the company in December 2021, had engaged in extensive self-dealing, sending tens of millions of dollars to companies they control.

Warren is “actively looking” into the Corizon Two-Step, Sarabia confirmed last week, before the settlement was announced. “You can expect future congressional oversight led by Senator Warren’s office.”

In court, Kaufman, the Tehum attorney, blamed Insider’s reporting for the company’s decision to to keep the details of the settlement secret.

“We don’t want our process derailed by misstatements about what the terms are or how they impact creditors or we don’t want creditors pre-judging the plan before it’s even filed,” he said.

A rushed timeline

US Bankruptcy Court, Southern District of Texas

Some creditors have worried for months that the company would reach a settlement on unfavorable terms. In June, several creditors filed a motion asking the court to appoint an independent trustee to oversee Tehum, arguing that the self-dealing by Tehum was tantamount to a “fraudulent transfer” of assets outside the reach of the creditors. They want the Two-Step unwound or YesCare’s assets to be consolidated with Tehum’s so there’s more money available to pay creditors. A hearing on the motion is set for September 5.

Lawmakers, including Warren and Sen. Dick Durbin, chairman of the Senate Judiciary Committee, view the Texas Two-Step as a misuse of the bankruptcy code. Johnson & Johnson famously deployed it to limit liability for mounting legal claims that its talcum powder caused cancer. But Corizon has used it to limit liabilities for millions of dollars in unpaid invoices from vendors as well.

“As this case shows,” Durbin told Insider last week, “corporations will keep trying to manipulate bankruptcy to game the justice system unless Congress puts a stop to it.”

During the hearing last Friday, Kaufman proposed a rough timeline, suggesting that Tehum and attorneys representing the unsecured creditors committee would jointly submit a detailed liquidation plan, as well as a proposed information package describing the plan, in late September.

Under that timeline, creditors would get just five business days to file an objection to the plan or the information package in advance of a court hearing before Judge Lopez. If he grants conditional approval at that hearing, Tehum would then send the package out to the full roster of several hundred creditors for a vote.

Nick Zluticky, a lawyer for the unsecured creditors committee, offered a statement during the hearing in support of the proposed settlement and timeline.

Many plaintiffs in the malpractice suits, however, are still in prison and don’t have timely access to correspondence.

Judge Lopez, echoing objections raised by several creditors’ attorneys during the hearing, agreed that five business days was not enough time for creditors to prepare objections. He urged the attorneys to disclose the details of the plan as soon as they could.

“There’s just a lot of different parties that want to read the deal and I think they’re going to be entitled to having some time to work through it,” Lopez said.

Kaufman declined to comment about whether he’d file sooner and how Tehum plans to reach incarcerated claimants. Lopez and Zluticky didn’t respond to requests for comment from Insider.